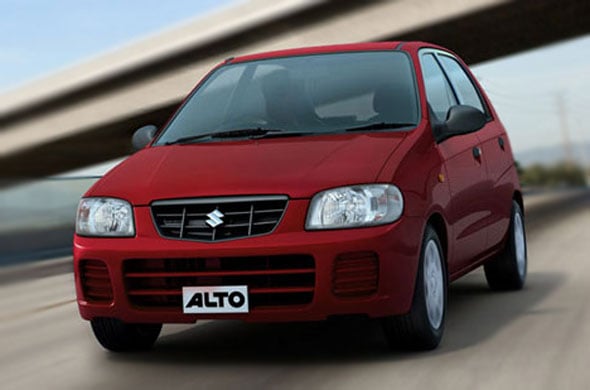

Maruti Suzuki, the most considered nameplate among new-vehicle shoppers

New-vehicle buyers in India are increasingly considering models in the utility vehicle and midsize car segments during the shopping process, according to the J.D. Power 2015 India Escaped Shopper StudySM (ESS) released today.

During the past four years, there has been a significant shift in the type of vehicles shoppers consider purchasing away from small cars to larger models. In 2015, the percentage of new-vehicle shoppers who consider small cars during their shopping process has decreased to 45 percent from 65 percent in 2012. Concurrently, the percentage of shoppers who consider utility vehicles and midsize cars has increased by 12 percentage points and 7 percentage points, respectively.

Today, price gaps between vehicle segments have narrowed, with many automakers offering models of different body types around the same price point. This has given new-car buyers a wider range of vehicles for consideration, including larger models

said Mohit Arora, executive director at J.D. Power.

Additionally, purchase consideration of newly launched models has increased among new-vehicle shoppers to the highest level in three years. In 2015, 10 percent of all shoppers consider a newly launched model vs. 7 percent in 2013. Notably, repeat vehicle buyers are typically more open than first- time purchasers when it comes to selecting a newly launched model.

Key Findings of this report

- In 2015, more new-vehicle buyers in India research the vehicle they consider than in 2014 (41% vs. 35%, respectively).

- More shoppers who consider a newly launched model use the Internet as a source of information for vehicle research than those who consider an existing model (51% vs. 45%, respectively).

- Among shoppers who consider a new model but later reject it, price is cited as the primary reason for rejecting (30%), followed by exterior design (21%) and fuel economy (18%).

- Maruti Suzuki is the most considered nameplate among new-vehicle shoppers for an 11th consecutive year, with 40 percent of all shoppers purchasing one of its models.

- Overall customer retention is at 37 percent in 2015, down slightly from 38 percent in 2014. Toyota has improved its customer retention rate the most from 2014.

The 2015 India Escaped Shopper Study is based on responses from 8,116 buyers and 2,983 rejecters of new cars and new utility vehicles who purchased their vehicle between September 2014 and April 2015. The study, which examines the reasons new-vehicle shoppers consider but ultimately reject certain models in favor of another, was fielded from March through July 2015.

Also read: Maruti Care app on iOS, Android and Windows