The Federation of Automobile Dealers Associations (FADA) voiced its concern over the dampened festive season and the de-growth which the automobile industry is currently staring at.

Commenting on the Navratri and Diwali festival sales, FADA President, Mr. Ashish Harsharaj Kale said,

We have not seen such a dull festive season, in the past few years as many negative factors came into play during this season which weakened the consumer sentiment and postponed their purchase decision. It is a matter of deep concern for our dealership community.

Higher de-growth was seen in the Navratri and Dussehra festivals, especially in two wheeler and passenger vehicles. With fuel prices starting their downward trend in October end, Diwali season saw a sales uptick, especially in two wheeler but overall, we have seen unusual de-growth during the combined festive period, both in two wheeler and Passenger Vehicle. Dealer inventory levels in both these segments have risen substantially as a result of this and is a matter of great concern.

Commercial vehicle sales which have been growing at a very good rate, still remained positive in their sales growth, but some demand softening could be seen in CV’s too as the growth percentage has come down during this period.

The ongoing NBFC Liquidity issue also is a concern for all the segments and especially for the two wheeler and commercial vehicle segment where we are seeing a cautious approach from the NBFC’s during and post Diwali season.

F A D A hopes that with the recent liquidity measures taken by the RBI and the Government, Auto NBFC’s and Banks would be better placed to continue their strong support to auto retails, which contributed majorly for the industry to grow at a healthy rate from April-Sept.

We request the Government and the RBI for further ease of liquidity for Auto NBFC’s, as they are one of the key growth drivers in Auto Retail and are also operating in a less riskier business environment than Infra and Housing NBFC’s due to the short repayment cycle of Auto Loans and the Mobility of the assets.

Concluding on a Positive note FADA President said,

We remain hopeful of recovery as overall inquiries during the festive period were robust, and postponement of Purchase was the main reason for muted sales. With positive policy measures, the possibility of consumer sentiment turning positive is quite strong as the agriculture produce is now coming to the markets, fuel prices are coming down substantially and infrastructure growth is still going strong as well as positive liquidity measures are being taken.

The auto retail industry can still deliver positive growth in the remaining 5 months of this FY and contribute substantially to the overall growth vision of our Government as consumer interest is still visible and strong and F A D A and its members will work strongly to achieve that

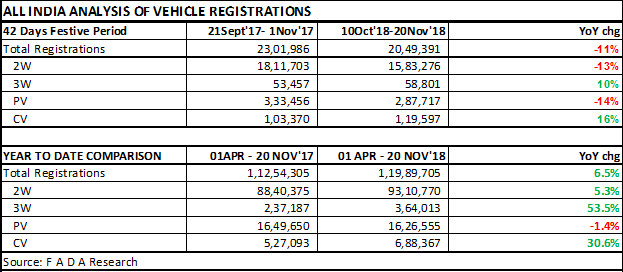

FADA is releasing the sales trends for the first time and these trends are based on vehicle registration figures from Navratri to 15 days post Dhanteras as there is a time lag of 10-12 days between delivery and registration. The sales numbers have been collated from its members and other sources and the chart below depicts vehicle registration trends during the festive season and covers almost 80% of the various regions of our country.

Our study shows that during the 42 days festive period and on YoY basis, total vehicle registrations fell by 11%, Two- Wheelers fell by 13% and Passenger Vehicles fell by 14%. 3 Wheelers and Commercial Vehicles held some ground and grew by 10% and 16%.

Going Forward FADA will be releasing these trends regularly and from April would be doing so region wise.

For the Current Financial Year up to 20th November’18 and on YoY basis, Total Vehicle Registrations has grown around 6%, 2Wheelers by 5%, 3Wheelers by 53% and Commercial Vehicles by 30%. Passenger Vehicles over the same period has de-grown by more than 1%.

The Inventory levels before the festivals began, were at around 60 days and 50 days for 2Wheelers and Passenger Vehicles. The same merely came down to around 50- and 45-days post Festivities and still remain higher than normal.

Highlights

- Unexpected de-growth during festival erases strong growth achieved till September

- Positive sales growth at FY end still a possibility, as consumer interest intact.

- Postponement of purchase by Consumers and the resultant Inventory increase a big concern for Auto Dealers

You can add more to this story by commenting below.